do you have to pay taxes when you sell a car in california

Selling a car for a profit If you sold your vehicle for more than what you purchased it for the story is different because you must pay taxes. If youre selling a car for less than you paid for it you will not have to pay taxes on it.

Used Cars For Sale In Temecula Ca Mercedes Benz Of Temecula Benz Mercedes Benz Mercedes

Diplomatic personnel of foreign nations are exempt from sales tax on vehicles.

. The exemption only applies if you are a single person or if you are married and file separate tax returns. You generally do not have to report and pay California sales or use tax on a vehicle that is sold and delivered outside of California for use outside California. Yes but in California you pay the sales tax when you register the car with the DMV.

Do not pay the sales tax to the owner. California has over 27 million licensed drivers with over 31 million registered vehicles. Vehicle registration or transfer to the American National Red Cross is not subject to use tax.

You will have to pay property tax on your car as well as for the lot that you park it on. However if you sell it for a profit higher than the original purchase price or what is called a capital gain you must report the windfall on your income tax return and pay taxes on it. If you are a California resident the short answer is yes.

California statewide sales tax on new used vehicles is 725. You will pay it to your states DMV when you register the vehicle. Do you have to pay income tax after selling your car.

The California Air Resources Board ARB at 800 242-4450. California collects a 75 state sales tax rate on the purchase of all vehicles of which 125 is allocated to county governments. California has a sales tax of 75.

Sometimes even if you sell the car for a little more than its actual value you dont have to pay tax for it. The exact rate due would depend upon the sellers tax brackets which would also be based on other income. Yes you must pay vehicle sales tax when you buy a used car if you live in a state that has sales tax.

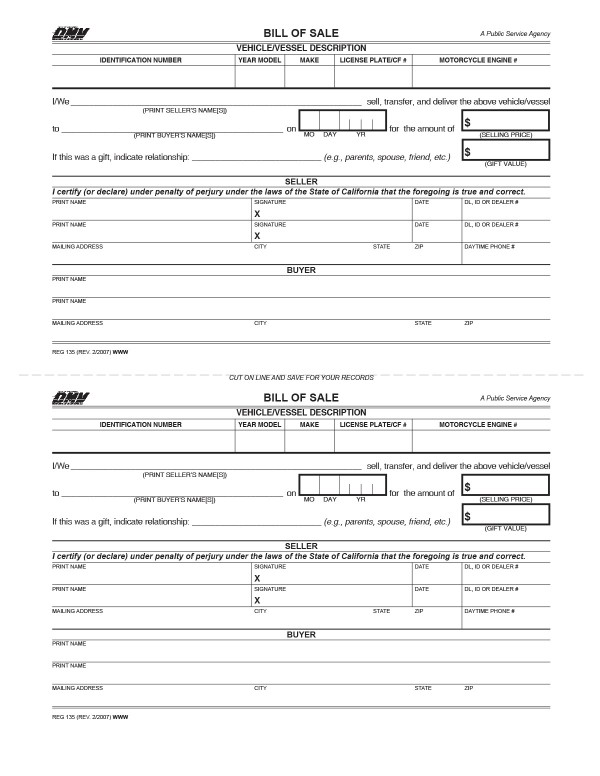

The long answer is that there is an exemption for all vehicles worth under 50000. When you privately sell a car in California the Bill of Sale does not need to be notarized. This means you do not have to report it on your tax return.

However you do not pay that tax to the car dealer or individual selling the car. The Department of Motor Vehicles Technical Compliance Section at 916 657-6795. The sales tax is higher in many areas due to district taxes.

Use tax applies to the sale of vehicles vessels and aircraft purchased from non-dealers for example private parties or from outside California for use in this state. Car registration is 60. According to the Sales Tax Handbook the California sales tax for vehicles is 75 percent.

Deciding if you must report auto sales to the IRS is fairly easy. Determining Capital Gain After Selling a Car. Keep in mind that you have to add the money that you invested in the vehicle after the purchase to the amount that you originally purchased the vehicle for.

On the title the previous. For more information on out-of-state vehicle purchases issues look to. Local governments such as districts and cities can collect additional taxes on the sale of vehicles up to 25 in addition to the state tax.

Of this 125 percent goes to. You must show evidence that the vehicle was delivered to the purchaser outside California for example by an employee or common carrier and that the purchaser did not take possession of the vehicle in California. When it comes time to calculate your total income to report on your 1040 form you need to.

This is because you did not actually generate any income from the sale of the vehicle. Some buyers and sellers do so anyways as it can add another level of protection to both parties. California Sales Tax on Car Purchases.

The Bureau of Automotive Repair BAR at 800 952-5210 smog emissions information. California sales tax generally applies to the sale of vehicles vessels and aircraft in this state from a registered dealer. But if the donor bought the car used for less than 10000 then there would be some capital gain on the sale which would be reported as part of ones California and United States income taxes in the year of the sale by the gift recipient.

Some areas have more than one district tax pushing sales taxes up even more.

Used Honda Car Dealerships Near Me Honda Accord Ex Honda Cars For Sale Honda Accord For Sale

These Are The States Whose Residents Pay The Highest Taxes Income Tax Tax Refund Income Tax Return

Rollie Auto Body Towing Car Body Shops In San Mateo California Call Us For Quality Auto Body In San Mateo We Specialize In A Car Insurance Car Buyer Car

California Bill Of Sale Form For Cars

How To Use A California Car Sales Tax Calculator

California Vehicle Sales Tax Fees Calculator

Important Tax Information For Used Vehicle Dealers California Dmv

How To Transfer A Car Title Nerdwallet

California Vehicle Tax Everything You Need To Know

California Looking Into Sales Tax On Services Sales Tax Tax Proposal

All About Bills Of Sale In California The Facts And Forms You Need

Pin On Vintage Car Ads Board 2

Used Vehicle California Sales Tax And California Board Of Equalization

Tracy Volkswagen Weekend New Car Sale Payments As Low As 39 On Jetta 49 Monthly On Vw Tiguan 209 229 7920 Vw Volksw Vw Cars For Sale New Cars Volkswagen

California Used Car Sales Tax Fees 2020 Everquote

California Title Transfer How To Sell A Car In California Quick

California Vehicle Fees Tax Title License Renewal Novato Toyota